Business Insurance in and around Jefferson City

One of Jefferson City’s top choices for small business insurance.

Insure your business, intentionally

Insure The Business You've Built.

When experiencing the wins and losses of small business ownership, let State Farm take one thing off your plate and help provide outstanding insurance for your business. Your policy can include options such as extra liability coverage, business continuity plans, and errors and omissions liability.

One of Jefferson City’s top choices for small business insurance.

Insure your business, intentionally

Protect Your Future With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a psychologist office, an interior decorator or an arts and crafts store. Agent John Conrad is also a business owner and understands your needs. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

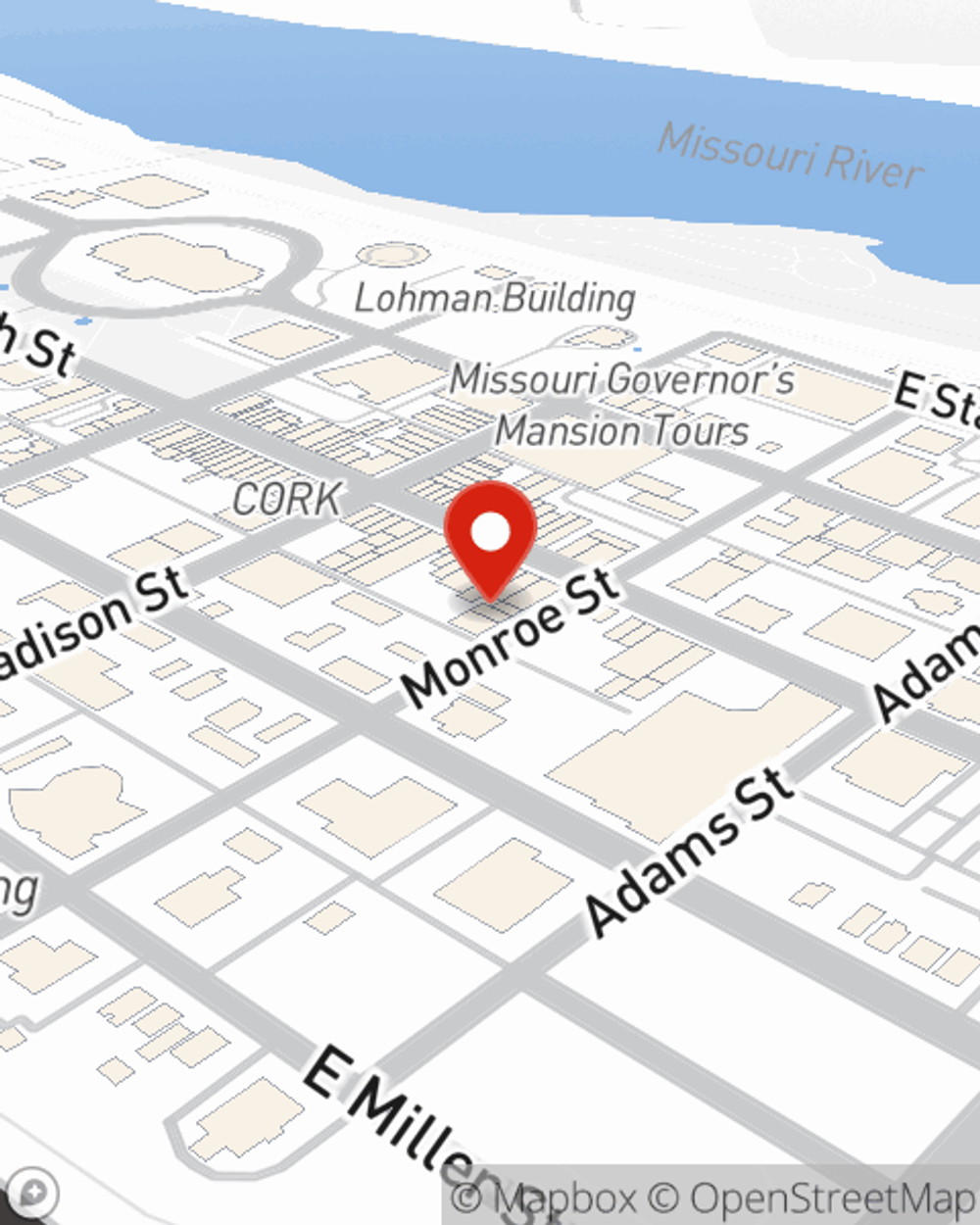

Get right down to business by visiting agent John Conrad's team to discuss your options.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

John Conrad

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.